ARE YOU, TOO, LOOKING FOR PROFITABLE INVESTMENT OPPORTUNITIES OFFERING PREDICTABLE RISK?

Like many investors you surely know that logistics property as asset class generates stable rents plus relatively high yields and that total return is well above office property. At the same time, running costs are proportionally low. Hence the enormous demand for logistics real estate – a trend likely to continue and increase. Yet, investments also bear high risks and it requires more than a standard property valuation to analyze and narrow these down.

Market and location report for logistics and industrial property investments

While logistics real estate has been an established asset class for many years, we currently see a record high of demand from investors. This is largely due to stable rents and comparatively high yields that, for example, exceed office property yields by 150 to 160 base points. To keep with this example, total return, too, ranges clearly above office property. Only retail property shows better performance. Also, initial yields are higher than those offered by alternative asset classes. Not forgetting the proportionally low running costs. Plus, logistics buildings are relatively simple structures. Unlike office property they normally don’t require a great deal of renovation work when tenants change.

As with all asset classes, location is considered one of the key factors for logistics real estate investors. The main focus should be put on core and core-plus segments because they promise high long-term rental income and easy re-letting. Since property in these prime locations is very scarce some investors may turn to logistics real estate in less attractive locations. This carries risks: What happens, for example, if a tenant moves out and a new tenant has to be found. Ideally, there is on-going logistics demand for the site and the area offers appropriate location factors while benefitting from a favorable economic situation. Also, the logistic property’s potential for alternative usage is important in order to enhance the choice of tenants.

To minimize investment risk, property valuations and market value appraisals have become a crucial part in investment decision-making. These reports are designed to reduce investment risk by identifying the current and the future value of the property, alternative usage options (re-deployability) and thus the potential for re-letting. In many cases, however, it is just the property and its immediate surrounds that are factored in and the property rating is just based on location criteria related to logistics real estate. This will not suffice to provide a sustainable assessment of the logistic property’s investment potential.

DIFFERENT LOGISTICS PROCESSES CALL FOR DIFFERENT TYPES OF LOGISTICS PROPERTY

The logistics industry is exceptionally heterogeneous. The requirements logistics companies have for logistics real estate and logistics sites very much depend on the product and services offered. Not every property is therefore equally suited for the implementation of logistics processes. Comprehensive logistics know-how is key for analyzing the logistics property and its suitability for the different logistics industries. This is the only way to determine actual re-deployability.

INDUSTRIAL VS. E-COMMERCE – EVERY INDUSTRY HAS ITS OWN SPECIFIC REQUIREMENTS FOR A PERFECT SITE

Not every location is equally suited for the many different types of logistics firms. Logistics sites used by online retailers, for example, are increasingly found in close proximity to urban areas or, in some cases, even in the cities. This helps accommodate consumer demand for faster delivery. Suppliers of automotive parts, on the other hand, will mainly settle near the manufacturers, whereas international contract logistics firms prefer sites that provide optimum infrastructure and access to road, rail, water and air, depending on their specific type of customers. To assess a logistics property investment it is also vital to carefully analyze existing and planned location factors like the set-up of a combined transportation terminal or a new freeway exit serving the site. The implementation of these projects should be monitored and included in the re-deployability rating. Last but not least, the overall economic and logistics region needs to be factored in as well.

AN EXTRA THAT PAYS OFF: THE MARKET AND LOCATION REPORT FOR LOGISTICS PROPERTY INVESTMENTS.

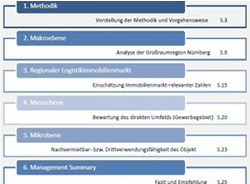

The extent of this report reaches far beyond mere property valuation. For one, the compilation of an additional logistics market and location report requires a high level of logistics process and logistics market expertise in order to be able to analyze and rate the requirements of different logistics segments for logistics real estate and, by implication, the property’s qualification for different industries. Not to mention the comprehensive location-based know-how and the many different economic and structure-related performance indicators, location factors, information about infrastructure, space ratio, etc., which need to be evaluated by applying special methodologies.

Logivest Concept have been recording for many years logistics real estate and logistics market performance indicators, developed methods of appraisal and benchmarked large amounts of information about different locations. The two organizations joined forces in order to provide investors, developers, banks and consultants with a reliable, independent and valuable additional tool for property valuation designed to reduce investment risk. The market and location report for logistics property investments delivers unbiased, objective support for making the right investment decision.

Please refer to our german database if you are looking for logistics property in specific regions.