Recession and high financing costs put the brakes on new logistics construction / Logivest publishes surveys on the volume of new construction as part of its annual logistics property seismograph / Positive outlook: Three million projected logistics hall spaces already under negotiation for 2024

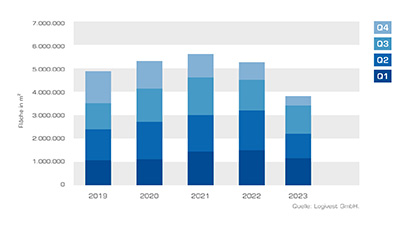

In 2023, the volume of new construction in the logistics property market declined noticeably. After evaluating its own research data as part of the annual logistics property seismograph, the integrated consultancy Logivest reports the start of construction of a total of around 3.8 million square metres of new logistics space in 2023 - around 1.4 million square metres and therefore almost 27 percent less than in 2022. The fourth quarter of 2023 was particularly weak with only around 400,000 square metres. The three largest new logistics property developments in the past year were a 260,000 square metre owner-occupation by Daimler Trucks in Halberstadt, a pre-let by GLP in Berlin Werder of around 127,000 square metres to Sonepar and Welog, among others, and a speculative new build of a good 112,000 square metres by Thirteen Seven/BentallGreenOak in Estorf.

"The overall economic environment in 2023 has dealt a double blow to new logistics property construction," says Kuno Neumeier, CEO of the Logivest Group. "Due to the weak economy and the new maximum rents, demand from tenants and owner-occupiers for new space was less pronounced than in previous years. This trend was exacerbated by the decline in online retail, which led some e-commerce companies to reduce previously built-up logistics overcapacity or postpone new construction projects. The second blow was the significant increase in financing costs compared to 2022, which made new developments more difficult for developers. Not only have financing costs risen, but in many cases it has been much more difficult to obtain financing at all due to the reluctance of banks."

In 2023, the volume of new construction in the logistics property market declined noticeably. After evaluating its own research data as part of the annual logistics property seismograph, the integrated consultancy Logivest reports the start of construction of a total of around 3.8 million square metres of new logistics space in 2023 - around 1.4 million square metres and therefore almost 27 percent less than in 2022. The fourth quarter of 2023 was particularly weak with only around 400,000 square metres. The three largest new logistics property developments in the past year were a 260,000 square metre owner-occupation by Daimler Trucks in Halberstadt, a pre-let by GLP in Berlin Werder of around 127,000 square metres to Sonepar and Welog, among others, and a speculative new build of a good 112,000 square metres by Thirteen Seven/BentallGreenOak in Estorf.

"The overall economic environment in 2023 has dealt a double blow to new logistics property construction," says Kuno Neumeier, CEO of the Logivest Group. "Due to the weak economy and the new maximum rents, demand from tenants and owner-occupiers for new space was less pronounced than in previous years. This trend was exacerbated by the decline in online retail, which led some e-commerce companies to reduce previously built-up logistics overcapacity or postpone new construction projects. The second blow was the significant increase in financing costs compared to 2022, which made new developments more difficult for developers. Not only have financing costs risen, but in many cases it has been much more difficult to obtain financing at all due to the reluctance of banks."

Top logistics regionsLeipzig/Halle logistics region rises from second to first place

The Leipzig/Halle region saw the most ground-breaking ceremonies in 2023 - with a good 275,000 square metres, it takes first place. Hanover is in second place with around 250,000 square metres, which is more than double the figure for 2022. Back then, the region was only in 14th place, while Berlin/Brandenburg came in third place, as it did in 2022, with around 235,000 square metres. Bringing up the rear in 2023 with less than 25,000 square metres of new-build space each were the regions of Munich, Koblenz, Saarland, Swabia and Erfurt. Rents for new builds ranged from EUR 5.00 per square metre per month to EUR 16. "One of the factors that explain the regional differences is property prices," explains Neumeier. The three most expensive markets are Munich (€10.50 to €16.00 per square metre), Stuttgart (€7.00 to €9.20 per square metre) and Hamburg (€7.50 to €9.00 per square metre).

The future belongs to brownfield sites

For the first time, Logivest has also included developed and projected greenfield and brownfield sites. While greenfield space totalled around 2.6 million square metres in 2023, brownfields accounted for less than half. However, a change is already emerging from 2024. Around 8 million square metres of projected greenfield space is then expected to be offset by around 5.5 million square metres of brownfield space. "We can see that brownfields are gaining in importance - because while around twice as much logistics space has been created on greenfields than on brownfields in recent years, the ratio will change in future. There is simply less and less greenfield space available in attractive locations. At the same time, greenfields are becoming increasingly difficult politically - both on a large scale at national level and on a small scale directly on site," explains Neumeier. While an average of 55 hectares per day were still being built on across all uses in 2021, the German government aims to reduce land consumption to less than 30 hectares per day by 2030. At the same time, municipal decision-makers often struggle with new greenfield logistics developments, as they do not always meet with approval from their local electorate. Brownfields, on the other hand, do not involve the sealing of new land and are usually in prime locations that are ideal for logistics.

Retail companies already seem to have bottomed out

The sector that demanded the most new space in 2023 was the logistics service provider sector with around 970,000 square metres (around 71% less than in 2022). Automotive companies came in second place with around 590,000 square metres (up around 169 percent), closely followed by retail companies with a good 570,000 square metres (down 40 percent). A look at the well-filled project pipeline shows that retail companies will potentially demand the most new build space from 2024 with a good 1.1 million square metres, followed by logistics service providers with around 845,000 square metres and automotive companies with around 460,000 square metres. "While logistics service providers are currently acting rather cautiously and prefer to extend existing leases instead of relocating and expanding into new buildings, retail companies saw a very clear decline from 2022 to 2023. However, this should change again from 2024," says Neumeier. This temporary decline in the retail segment is not solely due to e-commerce companies, Logivest's figures show. Although the demand for new space from online retailers fell by around 83% to around 115,000 square metres from 2022 to 2023, new space in the food and non-food segment of bricks-and-mortar retail and wholesale also fell noticeably in 2023.

Outlook: Market potential available

The fact that the logistics property market has great potential despite this year's slump is also shown by the project pipeline, which is still well filled. "Although not every planned project will be realised in 2024, we are talking about twelve to 13 million square metres of planned logistics property space, of which around three million square metres are already in concrete user negotiations," says Neumeier, adding: "Financing costs for new buildings have already fallen noticeably again in recent months, so we expect the market to recover from the second half of 2024."

The three regions with the greatest potential are Leipzig/Halle and Duisburg/Lower Rhine (over 1 million square metres each) and Berlin/Brandenburg (over 750,000 square metres). In contrast, there is little potential for new construction in the logistics regions of Erfurt, Danube and Stuttgart (less than 250,000 square metres in each case).

The entire survey on the volume of new construction in 2023 will be summarised in Logivest's logistics property seismograph and is expected to be available to download free of charge from the end of January 2024: https://www.logivest.de/infocenter/seismograph.

The Leipzig/Halle region saw the most ground-breaking ceremonies in 2023 - with a good 275,000 square metres, it takes first place. Hanover is in second place with around 250,000 square metres, which is more than double the figure for 2022. Back then, the region was only in 14th place, while Berlin/Brandenburg came in third place, as it did in 2022, with around 235,000 square metres. Bringing up the rear in 2023 with less than 25,000 square metres of new-build space each were the regions of Munich, Koblenz, Saarland, Swabia and Erfurt. Rents for new builds ranged from EUR 5.00 per square metre per month to EUR 16. "One of the factors that explain the regional differences is property prices," explains Neumeier. The three most expensive markets are Munich (€10.50 to €16.00 per square metre), Stuttgart (€7.00 to €9.20 per square metre) and Hamburg (€7.50 to €9.00 per square metre).

The future belongs to brownfield sites

For the first time, Logivest has also included developed and projected greenfield and brownfield sites. While greenfield space totalled around 2.6 million square metres in 2023, brownfields accounted for less than half. However, a change is already emerging from 2024. Around 8 million square metres of projected greenfield space is then expected to be offset by around 5.5 million square metres of brownfield space. "We can see that brownfields are gaining in importance - because while around twice as much logistics space has been created on greenfields than on brownfields in recent years, the ratio will change in future. There is simply less and less greenfield space available in attractive locations. At the same time, greenfields are becoming increasingly difficult politically - both on a large scale at national level and on a small scale directly on site," explains Neumeier. While an average of 55 hectares per day were still being built on across all uses in 2021, the German government aims to reduce land consumption to less than 30 hectares per day by 2030. At the same time, municipal decision-makers often struggle with new greenfield logistics developments, as they do not always meet with approval from their local electorate. Brownfields, on the other hand, do not involve the sealing of new land and are usually in prime locations that are ideal for logistics.

Retail companies already seem to have bottomed out

The sector that demanded the most new space in 2023 was the logistics service provider sector with around 970,000 square metres (around 71% less than in 2022). Automotive companies came in second place with around 590,000 square metres (up around 169 percent), closely followed by retail companies with a good 570,000 square metres (down 40 percent). A look at the well-filled project pipeline shows that retail companies will potentially demand the most new build space from 2024 with a good 1.1 million square metres, followed by logistics service providers with around 845,000 square metres and automotive companies with around 460,000 square metres. "While logistics service providers are currently acting rather cautiously and prefer to extend existing leases instead of relocating and expanding into new buildings, retail companies saw a very clear decline from 2022 to 2023. However, this should change again from 2024," says Neumeier. This temporary decline in the retail segment is not solely due to e-commerce companies, Logivest's figures show. Although the demand for new space from online retailers fell by around 83% to around 115,000 square metres from 2022 to 2023, new space in the food and non-food segment of bricks-and-mortar retail and wholesale also fell noticeably in 2023.

Outlook: Market potential available

The fact that the logistics property market has great potential despite this year's slump is also shown by the project pipeline, which is still well filled. "Although not every planned project will be realised in 2024, we are talking about twelve to 13 million square metres of planned logistics property space, of which around three million square metres are already in concrete user negotiations," says Neumeier, adding: "Financing costs for new buildings have already fallen noticeably again in recent months, so we expect the market to recover from the second half of 2024."

The three regions with the greatest potential are Leipzig/Halle and Duisburg/Lower Rhine (over 1 million square metres each) and Berlin/Brandenburg (over 750,000 square metres). In contrast, there is little potential for new construction in the logistics regions of Erfurt, Danube and Stuttgart (less than 250,000 square metres in each case).

The entire survey on the volume of new construction in 2023 will be summarised in Logivest's logistics property seismograph and is expected to be available to download free of charge from the end of January 2024: https://www.logivest.de/infocenter/seismograph.